Humanoids vs Cobots: Manufacturing Automation Comparison

Humanoid Robots (Tesla, Figure) vs. Cobots (UR, Fanuc): A Technical Comparison

Key Takeaway

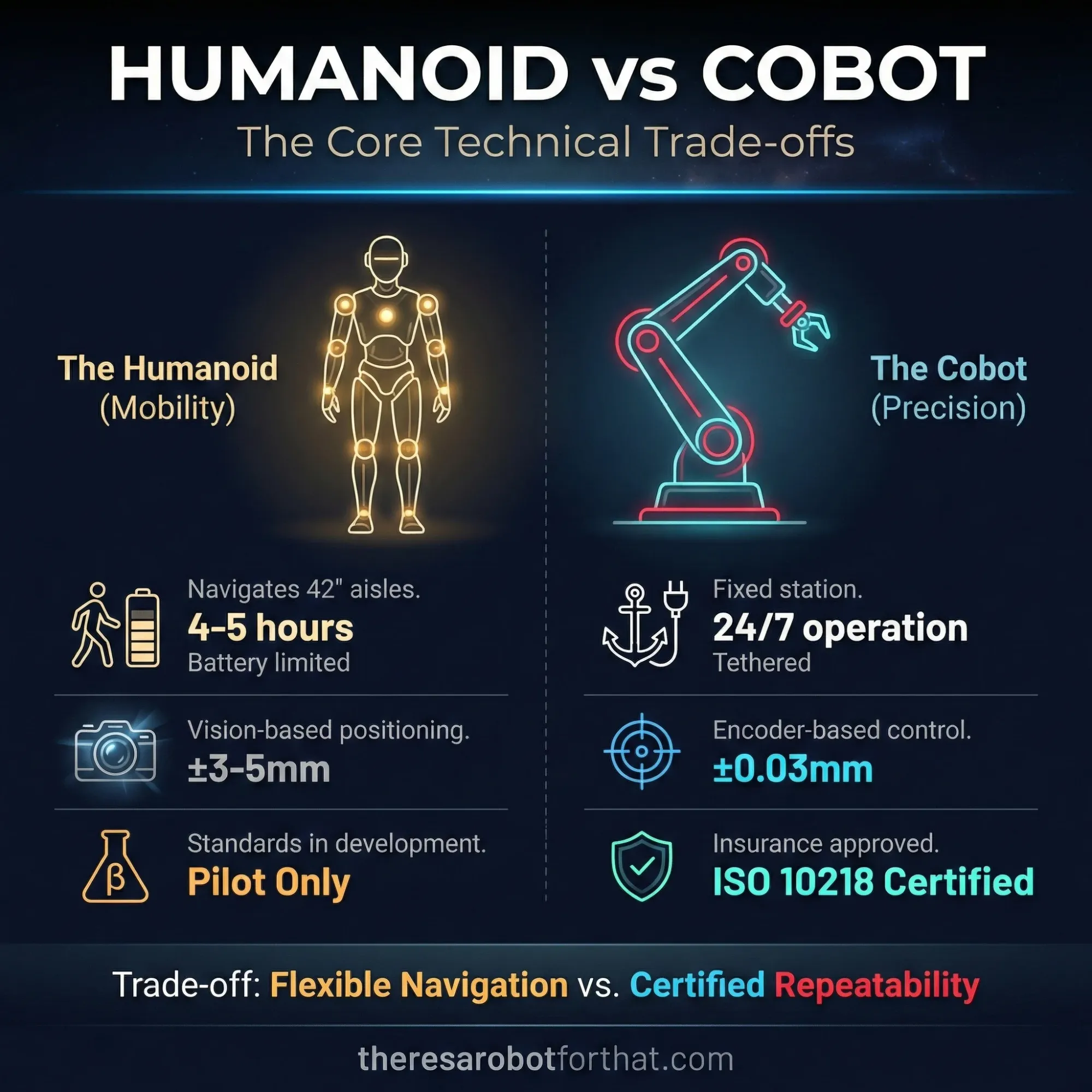

The primary trade-off in humanoid robots vs cobots manufacturing decisions is between mobile adaptability and certified stationary precision.

- Humanoids navigate brownfield spaces; cobots need fixed stations

- Cobots deliver 10-12.5kg consistently; humanoids vary 9-20kg

- Cobots have ISO 10218 certification; humanoids lack standards

Last updated: 25 January 2026

Your CFO asks why the plant isn't using Tesla Bots yet. Your floor manager wants cobots for CNC tending. Both are right for different reasons.

US manufacturing operates in brownfield facilities built for humans. Aisles measure 42 inches wide. Floors have expansion joints. Stairs connect production levels. Traditional automation requires you to redesign the entire layout. Humanoid robots promise to walk through your existing door.

This comparison moves beyond promotional videos to engineering reality. We examine payload capacity, power requirements, safety certifications, and total cost of ownership.

The Specs Showdown

While cobots like the UR10e offer continuous tethered power and 12.5kg payloads, humanoids like Figure 02 provide mobile manipulation with 4-5 hour battery limits. The operational difference matters more than marketing suggests.

According to Universal Robots' technical specifications, the UR10e handles payloads up to 12.5kg with a 1,300mm reach. It runs 24/7 on tethered power. No battery swaps. No charging downtime.

Tesla's official specifications list Optimus Gen 2 at approximately 20kg total body payload capacity. Arm strength sits around 9-10kg per arm. The robot operates 4-5 hours per battery cycle. Your second shift needs a charged battery ready.

Figure AI reports the Figure 02 carries 20kg (44 lbs) payload capacity. The bipedal design distributes weight differently than stationary arms. Battery life matches Tesla's range at 4-5 hours under continuous operation.

| Feature | UR10e | Fanuc CRX-10iA | Tesla Optimus Gen 2 | Figure 02 | Agility Digit |

|---|---|---|---|---|---|

| Payload | 12.5kg | 10kg | 9-10kg (arms) | 20kg | 16kg |

| Reach/Height | 1,300mm | 1,418mm | 1.73m tall | 1.55m tall | 1.75m tall |

| Power | Tethered AC | Tethered AC | Battery (4-5hr) | Battery (4-5hr) | Battery (4hr) |

| Mobility | Fixed base | Fixed base | Bipedal walking | Bipedal walking | Bipedal walking |

| Precision | ±0.03mm | ±0.02mm | ±5mm (vision-based) | ±3mm (vision-based) | N/A (logistics focus) |

| Price (2026) | ~$50,000 | ~$55,000 | Pilot only (~$150k) | RaaS (~$100k/yr) | RaaS (~$120k/yr) |

| Availability | Production | Production | Limited pilot | Limited pilot | Limited pilot |

The price gap reflects maturity. Cobots ship next week. Humanoids require pilot agreements and site assessments.

Tethered power means cobots run continuously. A UR10e operates three shifts without intervention. Humanoids need battery management systems. Your facility needs charging infrastructure. Factor 30 minutes per swap into cycle time calculations.

Precision differs by design philosophy. Cobots use encoders and hard stops for repeatability within 0.03mm. Humanoids use vision systems and force feedback. They adapt to position variance but sacrifice absolute precision. A cobot welds the same spot 10,000 times. A humanoid finds "the bin" even when someone moved it.

The Case for Cobots (The Safe Bet)

According to industry standards, cobots remain the preferred choice for stationary tasks due to established ISO 10218 safety certifications and 99.9% operational uptime. Regulatory compliance is not theoretical for collaborative robots.

ISO 10218-1 defines safety requirements for industrial robots. ISO/TS 15066 extends these standards to collaborative operation. Your insurance carrier recognizes these certifications. Your safety officer signs off without custom risk assessments.

Cobots operate in four collaborative modes: safety-rated monitored stop, hand guiding, speed and separation monitoring, and power and force limiting. Each mode has defined parameters. You know exactly what "collaborative" means in your facility.

Supply chains for cobot parts exist globally. A UR10e uses standard industrial components. Replacement parts ship within 48 hours. Service technicians train through established programs. Your maintenance team already knows how to troubleshoot PLC communication and teach pendant interfaces.

Operational uptime for established cobot models exceeds 99%. A UR10e runs 8,700+ hours annually with scheduled maintenance. Downtime is predictable. You schedule it during planned shutdowns.

Best For:

- CNC machine tending with fixed load/unload points

- Palletizing operations with consistent box dimensions

- Pick-and-place tasks with known object locations

- Welding applications requiring ±0.05mm repeatability

- Assembly stations with pre-positioned components

The cobot excels when the task repeats. Your product changes weekly but the motion path stays constant. Program once, run thousands of cycles. ROI calculations use proven data from similar deployments.

The Case for Humanoids (The Disruptor)

Humanoid robots excel in unstructured brownfield environments where end-to-end neural networks allow them to navigate existing human workflows without facility redesigns. The AI advantage appears in tasks that defeat traditional automation.

A bin arrives with parts randomly oriented. A traditional robot fails. It expects coordinates. A humanoid with vision-language models sees "grab the red connector" and adapts. The neural network trained on millions of simulated scenarios. It handles variance without reprogramming.

The walk-in factor matters in brownfield facilities. Your aisles measure 42 inches. Your stairs connect production floors. Your loading dock has a 6-inch step. Wheeled robots require ramps and widened paths. Humanoids navigate the infrastructure you already have.

Figure AI's partnership with BMW at the Spartanburg plant demonstrates real-world deployment. The Figure 02 handles sheet metal parts in the body shop. Tasks include parts insertion and quality inspection. BMW reports the robot operates in spaces previously accessible only to human workers.

Amazon's Agility Digit pilot focuses on tote handling in fulfillment centers. The robot walks between stations. It climbs stairs to reach mezzanine storage. Traditional automation would require conveyor systems and structural modifications costing millions.

The AI advantage extends to object recognition. A humanoid identifies "the damaged box" or "the misaligned part" through vision processing. It doesn't need barcodes or fiducial markers. The system learns from corrections. Show it once, it remembers.

Unstructured tasks favor humanoids. Sorting mixed recycling. Handling soft goods like textiles. Inspecting variable assemblies. These workflows resist traditional automation because variance is the norm, not the exception.

Battery limitations constrain deployment. A 4-hour runtime means one robot covers one shift, or you implement battery swap protocols. Your facility needs charging infrastructure and spare battery inventory. Factor this into TCO calculations.

Current pilots operate in controlled zones. BMW's Figure 02 works in a defined area with safety observers. Amazon's Digit handles specific routes. Unrestricted collaboration across your entire facility remains future-state.

Decision Matrix (When to Buy What)

Engineers should select cobots for repetitive precision tasks requiring immediate ROI, while reserving humanoid pilots for workflows requiring mobility across uneven terrain or stairs. The decision tree is clearer than vendor marketing suggests.

If your task is stationary with fixed I/O points → Buy a cobot.

Machine tending, palletizing, welding, and assembly with known coordinates fit cobot capabilities. You need ISO-certified safety and proven uptime. The UR10e or Fanuc CRX ships in weeks and operates for years.

If your task requires walking between stations → Pilot a humanoid.

Tote transport across multiple zones. Parts delivery up stairs. Inspection routes covering 500+ feet. These workflows justify humanoid evaluation. Expect 6-12 month pilot programs and custom integration.

If your payload exceeds 20kg consistently → Buy a traditional industrial arm.

The Fanuc M-20iA handles 20kg. The M-710iC handles 70kg. Neither is collaborative, but both deliver the capacity. Heavy lifting remains the domain of traditional automation.

If your task involves unstructured object handling → Consider humanoid pilots.

Sorting mixed bins. Handling deformable materials. Adapting to product variation without reprogramming. Vision-based manipulation justifies the premium when programming costs exceed hardware costs.

If you need deployment in Q2 2026 → Cobots are the only production option.

Humanoids remain in limited pilot availability. Figure and Agility operate RaaS models with waitlists. Tesla Optimus has not announced general availability. Your timeline dictates technology choice.

If regulatory compliance is non-negotiable → Cobots provide certified solutions.

ISO 10218 certification exists. Insurance carriers recognize it. Safety officers approve it. Humanoid safety standards are in development but not finalized.

Financial Analysis (ROI & TCO)

Cobots offer a proven 12-18 month ROI at approximately $50,000 per unit, whereas humanoids currently represent an R&D investment with pilot costs often exceeding $150,000. The cost structures differ fundamentally.

A UR10e costs $50,000. Add $15,000 for end-effector tooling and integration. Total deployment: $65,000. The robot replaces one FTE at $45,000 annual labor cost (including benefits). Payback occurs in 17 months. This calculation uses data from thousands of deployed units.

Humanoid pricing remains fluid. Figure 02 operates under RaaS models estimated at $100,000-$150,000 annually. This includes the robot, software updates, and support. You avoid capital expenditure but commit to multi-year contracts.

Tesla's target price of $20,000 appears in promotional materials. Current reality sits closer to $150,000 for pilot programs. The gap between "target" and "available" matters for 2026 budgets. Plan using actual pilot costs, not future projections.

Hidden costs differ by technology. Cobots require integration labor (typically $10,000-$30,000) and periodic maintenance ($2,000-$5,000 annually). Parts availability is immediate. Your maintenance team handles routine service.

Humanoids add infrastructure costs. Battery charging stations run $5,000-$15,000. You need spares for continuous operation. Software updates arrive over-the-air but require IT security approval. Budget for network infrastructure and cloud connectivity.

Beta testing costs are real. Early humanoid adopters provide feedback to manufacturers. You're developing the use case, not deploying proven workflows. Engineering time for pilot programs ranges from 200-500 hours. Factor this labor cost into TCO.

Labor replacement ROI for humanoids remains theoretical until unit costs drop below $50,000. At $150,000 per unit, you need the robot to replace 3+ FTEs or provide capabilities impossible with human labor. The value proposition shifts from cost reduction to capability expansion.

Maintenance contracts for cobots cost 8-12% of purchase price annually. A $50,000 UR10e runs $4,000-$6,000 per year for coverage. Humanoid maintenance costs lack historical data. Early pilots report higher support requirements during learning phases.

Depreciation schedules differ. Cobots depreciate over 7 years under MACRS. Humanoid accounting treatment varies by RaaS vs. purchase structure. Consult your finance team before committing to pilot programs.

The Human Factor

Worker acceptance determines pilot success more than technical specifications. Floor workers react with curiosity and anxiety when a 1.7-meter robot starts working beside them.

The humanoid form triggers responses wheeled robots don't. Workers attribute intent to bipedal machines. A wheeled AMR that stops is a glitch. A humanoid that stops while facing you triggers threat assessment. This is psychology, not engineering, but it affects deployment.

Successful pilots communicate early. Let workers control the robot via teleoperation before autonomous operation. Show them the robot handles dull, dirty, dangerous tasks. Their jobs evolve toward oversight and exception handling.

BMW's approach included worker councils in the Figure 02 evaluation. Operators tested the robot in controlled settings. Feedback shaped deployment zones and task selection. Worker buy-in preceded production deployment.

The "job replacement" narrative damages acceptance. Frame humanoids as capacity expansion, not headcount reduction. Your facility has open requisitions you can't fill. The robot takes the unfilled position. Existing workers move to higher-value tasks.

Training requirements differ. Cobot programming uses teach pendants and visual interfaces. Production workers learn basic programming in 2-3 days. Humanoid operation currently requires specialist oversight. The skill gap will narrow, but plan for it in 2026.

Common Pitfalls

Choosing humanoids for stationary tasks. If the robot doesn't need to walk, buy a cobot. Mobility costs battery life and precision.

Underestimating floor requirements. Uneven joints and debris trip bipedal robots. Measure friction coefficients, don't guess. Oil residue on concrete stops humanoids.

Ignoring IT security for cloud-connected robots. Humanoids need cloud access for neural network updates. Your IT team blocks external connections by default. Engage them in Phase 1.

Assuming "collaborative" means "unrestricted access." Even cobots have speed and force limits. Read ISO/TS 15066. Understand power and force limiting requirements.

Budgeting only for hardware. Integration labor, charging infrastructure, and training costs add 30-50% to hardware price. Build complete TCO models.

Deploying humanoids without battery swap protocols. A 4-hour runtime means shift changes require charged batteries. You need spares and swap procedures.

Limitations & Alternatives

Humanoids don't replace all automation. Payloads above 20kg require industrial arms. Precision below ±1mm requires cobots or dedicated automation. Speed requirements above 2 m/s need specialized systems.

Autonomous Mobile Robots (AMRs) handle many logistics tasks humanoids target. A wheeled AMR costs $30,000-$80,000 and operates 8+ hours per charge. If your facility has level floors and no stairs, AMRs deliver better ROI than humanoids.

Traditional conveyors still win for high-volume, fixed-path transport. Moving 1,000 units per hour between two points costs less with a conveyor than with any robot type.

Exoskeletons augment human workers for tasks requiring judgment and dexterity. A $5,000 exoskeleton reduces injury risk without replacing the worker. Consider this for tasks that resist full automation.

Conclusion

The humanoid robots vs cobots manufacturing decision comes down to task requirements and timeline. Cobots deliver certified safety, proven ROI, and immediate availability for stationary precision work. Humanoids offer mobile adaptability for unstructured brownfield environments, but remain in pilot phases with premium pricing.

Buy cobots for CNC tending, palletizing, and assembly tasks with fixed I/O points. Pilot humanoids for logistics workflows requiring stairs, uneven terrain, or vision-based object handling. Avoid humanoids for stationary tasks where cobots already excel.

The $20,000 humanoid exists in roadmaps, not purchase orders. Budget using 2026 reality: $50,000 for cobots, $100,000-$150,000 for humanoid pilots. ROI timelines reflect this cost difference.

Your facility's infrastructure determines technology fit. Brownfield sites with stairs and narrow aisles favor humanoids. Facilities with level floors and defined work cells favor cobots. Match the robot to the space, not the hype cycle.

FAQ

What is the difference between a humanoid robot and a cobot?

The primary difference is mobility versus stability. Cobots are stationary arms bolted to a surface, offering high precision (±0.03mm) and ISO-certified safety for collaborative work. Humanoid robots are mobile, bipedal units designed to navigate unstructured environments and mimic human movement. While cobots excel at repetitive tasks like welding, humanoids are built for logistics and multi-purpose handling in spaces designed for people.

How much does a Figure 02 robot cost?

As of 2026, the Figure 02 is primarily available through Robot-as-a-Service (RaaS) pilot programs rather than direct purchase. Industry analysts estimate the effective cost for early adopters ranges between $100,000 and $150,000 annually, including support. Figure AI aims to reduce unit production costs to compete with automotive labor rates, but mass-market pricing under $50,000 has not yet been standardized for single-unit buyers.

Can Tesla Optimus lift heavy loads?

Tesla Optimus Gen 2 has a rated payload capacity of approximately 20 kg (44 lbs) for the full body, but arm strength is lower. Specifically, the hands are designed for dexterity rather than heavy industrial lifting, with a limit of roughly 9-10 kg per arm. For heavy manufacturing tasks exceeding 20 kg, traditional industrial arms or high-payload cobots (like the UR20) remain the required standard.

Are humanoid robots safe for factories?

Humanoid robots currently lack specific ISO safety standards comparable to the ISO 10218 certification for cobots. While they utilize advanced vision systems and force-limiting technology to avoid collisions, they are generally deployed in controlled pilots or "fenced" virtual zones. Regulatory bodies are currently developing specific safety frameworks for mobile bipedal robots in shared workspaces, but unrestricted collaboration is not yet industry-standard.

References

- Universal Robots - UR10e Technical Specifications - https://www.universal-robots.com/products/ur10-robot/

- Tesla AI - Optimus Gen 2 Specifications and Development Updates - https://www.tesla.com/AI

- Figure AI - Figure 02 Specifications and BMW Spartanburg Pilot Information - https://www.figure.ai/

- ISO Standards - ISO 10218-1 Safety Requirements for Industrial Robots - https://www.iso.org/standard/51330.html

- Amazon News - Agility Digit Pilot Program and Robotics Solutions - https://www.aboutamazon.com/news/operations/amazon-introduces-new-robotics-solutions